RXIL's First Trade Credit Insurance Transaction in Sandbox

ANI

25 Nov 2020, 18:25 GMT+10

Mumbai (Maharashtra) [India], November 25 (ANI/NewsVoir): Receivables Exchange of India Ltd. (RXIL) recently initiated a Trade Credit Insurance (TCI) backed transaction with Tata AIG as the insurer and ICICI Bank, YES Bank as the financiers in Sandbox environment.

This is the first time a TReDS platform has tested the efficacy of TCI backed transaction improving the ability of financiers in assigning credit limits to corporates. TCI, once implemented post regulatory approvals, will enable financiers to discount the invoices drawn on lower rated corporate buyers, by their MSME sellers and will improve the liquidity from lenders.

The adoption of Trade Credit Insurance on TReDS will pave the way for a completely digital bite-sized credit insurance model. Buying credit insurance on TReDS will be as simple as buying travel insurance while buying an air ticket on a travel portal, devoid of the lengthy paperwork generally associated with trade insurance.

"There has been a need for Trade Credit Insurance (TCI) on TReDS, we are glad that the regulators provided us with a roadmap in a time-bound manner. TCI will help financiers in mitigating the risk of non-payment and insolvency/defaults of the buyers. We collaborated with TATA AIG as the insurer, ICICI and YES Bank as financiers to execute the transaction. This is expected to increase the current throughput of the platform and put our country ahead in league with other developed markets the way this product has been designed," said Ketan Gaikwad, MD and CEO of Receivables Exchange of India Pvt. Ltd.

Trade Credit Insurance is a structural reform that has been re-introduced in India after a gap of 10 years. Globally, factoring and insurance go hand in hand, however, in India, both are being seen with a renewed interest as the economy is gradually moving towards formalisation of small businesses.

TCI on TReDS was one of the recommendations by U.K Sinha Committee report on MSME credit. The working group constituted by IRDAI reviewed the guidelines on TCI, which has paved the way for testing in Sandbox environment.

"We are delighted to partner with RXIL for the Trade Credit Insurance (TCI) and successfully piloting the test transaction under IRDA's regulatory sandbox proposal of TATA AIG. We are sure that TCI will significantly increase the ability of the buyers to get financiers to discount the invoices raised by their MSME suppliers, thereby benefitting a much larger universe of MSMEs. We believe TCI will gather further momentum when it gets approved as Credit Risk Mitigation Technique for lending," said Ajay Gupta, Head Transaction Banking and SMEG, ICICI Bank.

"With this successful pilot of the Trade Credit Insurance (TCI) backed structure in the Sandbox environment, YES BANK in partnership with RXIL has taken yet another significant step in its efforts towards digitizing and bringing efficacy in the financial supply chain arrangement between Corporate Buyers and their MSME sellers," said Ajay Rajan, Global Head - Transaction Banking Group, YES Bank.

"TCI being a globally accepted Trade FinancingCredit Enhancement structure could potentially help in augmenting and expanding the scope of supply chain financing, thereby supporting the 'Atmanirbhar Bharat' initiative of the Government," Ajay Rajan added.

Risk management and mitigation is an important component of a well-oiled supply chain that drives the economic engine. A simplified trade credit insurance regime that includes MSMEs will encourage more liquidity from lenders and improve the industry's resilience allowing them to expand faster.

Receivables Exchange of India is an RBI accredited TReDS (Trade Receivables Discounting System) Exchange Platform that started as a joint venture between Small Industries Development Bank of India (SIDBI) and National Stock Exchange of India Limited (NSE) with State Bank, ICICI and Yes Bank as other stakeholders.

RXIL empowers small businesses to realize their growth potential by accelerating their collections. With its innovative digital platform, MSMEs today can auction their trade receivables on a non-recourse basis at competitive rates, through online bidding by financiers, and gain access to capital in less than 48 hours. This helps MSMEs ease liquidity problems and puts a healthy cash flow back into their working cycles for smoother runs in their businesses. RXIL has over 4,800 MSMEs, 550 buyers and 39 financiers on the platform.

This story is provided by NewsVoir. ANI will not be responsible in any way for the content of this article. (ANI/NewsVoir) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Broadcast Communications news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Broadcast Communications.

More InformationBusiness

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

Sectors - Broadcasting

SectionSBA participates in World News Media Conference 2025 in Poland

SHARJAH, 7th May, 2025 (WAM) -- The Sharjah Broadcasting Authority (SBA) recently took part in the 76th World News Media Congress,...

France returns military base to Senegal

Paris is withdrawing its troops after the African country scrapped a decades-old defense agreement France has handed over a military...

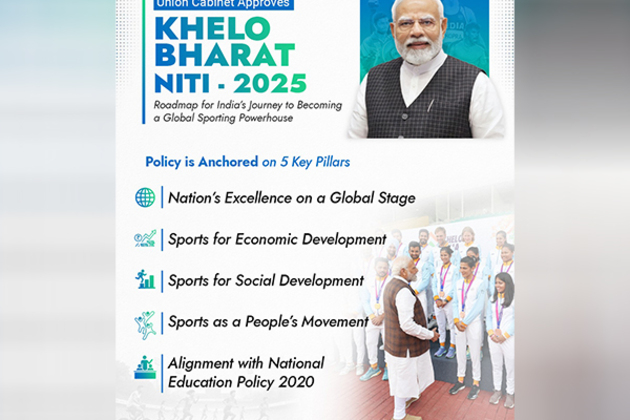

"Landmark day for India's efforts to encourage sporting talent": New National Sports Policy 2025 approval

New Delhi [India], July 1 (ANI): On the occasion of the approval of the new 'Khelo Bharat Niti 2025', Prime Minister Narendra Modi...

Indian Institute of Creative Technologies begins admissions for Animation, Visual Effects, Gaming, in August

Mumbai (Maharashtra) [India], July 1 (ANI): The Indian Institute of Creative Technologies (IICT) opens admissions for its first batch...

Cabinet approves Research and Development and Innovation scheme with corpus of Rs 1 lakh crore to boost strategic, sunrise domains

New Delhi [India], July 1 (ANI): In a significant step to bolster India's research and innovation ecosystem, the Union Cabinet on Tuesday...

Georgia Risks EU Sanctions; Ukraine Hits Roadblocks In NATO, EU Bids

Welcome to Wider Europe, RFE/RL's newsletter focusing on the key issues concerning the European Union, NATO, and other institutions...