Economic Watch: U.S. economy faces inflation, tax hikes: experts

Xinhua

03 May 2021, 13:00 GMT+10

by Matthew Rusling

WASHINGTON, May 3 (Xinhua) -- The U.S. economy saw a massive drop last year due to the COVID-19 pandemic. With a package of stimulus plans unveiled recently, some economists and Republicans were worried about the possibility of economic inflation and tax hikes.

The U.S. economy grew at an annual rate of 6.4 percent in the first quarter of 2021, due to a 2-trillion-U.S. dollar stimulus plan, according to the U.S. Commerce Department.

However, some economists have expressed concern over economic inflation due to government overspending, as well as the possibility of tax hikes. OVERSPENDING

Brookings Institution Senior Fellow Barry Bosworth told Xinhua that President Joe Biden's stimulus may risk a significant acceleration of inflation.

Desmond Lachman, resident fellow at the American Enterprise Institute, told Xinhua that Biden's stimulus "is bound to lead to an overheated U.S. economy and an unwelcome acceleration in inflation by year end."

"History will not judge Joe Biden kindly for his handling of the U.S. economy in his first 100 days in office. I also think that his economic policies are likely to cost him dearly at next year's midterm elections," Lachman added.

The massive budget stimulus will occur as the Federal Reserve has put its pedal to the metal in terms of monetary policy stimulus, and at a time when there is a large amount of household pent-up demand, in the wake of the pandemic.

"The real risk that Mr. Biden is taking is that his policies will produce a very strong boom this year that will force the Federal Reserve to slam on the monetary policy brakes by year end," Lachman said.

This in turn would risk bursting today's global asset prices and credit market, which could send the U.S. economy into another economic recession next year, he said.

Last month Biden announced a Goliath infrastructure plan with a price tag of 2.3 trillion dollars, which he called "a once-in-a-generation investment in America."

But opponents fret that Biden could waste more money on pork and a progressive wish list, arguing that he did just that with over half of the recent stimulus bill.

Lachman argued that Biden's infrastructure proposal would occur as the U.S. budget deficit and public debt level will already be at record highs.

"My take on the Biden infrastructure spending proposal is that it is but the latest example of recent U.S. administrations' total disregard for sound budget management," Lachman said.

"This disregard does not bode well for the country's future long-run economic performance," he said. TAX HIKES

Earlier this week Biden unveiled his American Families Plan -- a proposal that aims to raise 1.8 trillion dollars over a 10-year period by hiking taxes on the top 1 percent of Americans.

The president's tax plan would also increase capital gains taxes for those who earn over 400,000 dollars a year.

Biden said those earning under 400,000 dollars annually would not see a tax hike, but emphasized that it was time that the nation's top earners and companies "pay their fair share."

Republicans have blasted Biden's plans, contending that the agenda involves far too much spending and that the president's tax plans could harm the economy.

Many also contend that the wealthy do not pay taxes anyway, and that any tax increase will end up being paid for by the middle class.

According to new study from the University of Pennsylvania's Wharton Business School, top earners will avoid paying 90 percent of Biden's estimated 1-trillion-dollar tax hike.

The study's researchers found that tax avoidance -- which is largely legal -- would slash almost 900 billion dollars in tax receipts from Biden's estimated 1-trillion-dollar tax increase.

Experts also said Biden's proposed capital gains tax increases could hurt the U.S. stock market, and harm tens of millions of Americans.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Broadcast Communications news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Broadcast Communications.

More InformationBusiness

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

Sectors - Broadcasting

SectionSBA participates in World News Media Conference 2025 in Poland

SHARJAH, 7th May, 2025 (WAM) -- The Sharjah Broadcasting Authority (SBA) recently took part in the 76th World News Media Congress,...

France returns military base to Senegal

Paris is withdrawing its troops after the African country scrapped a decades-old defense agreement France has handed over a military...

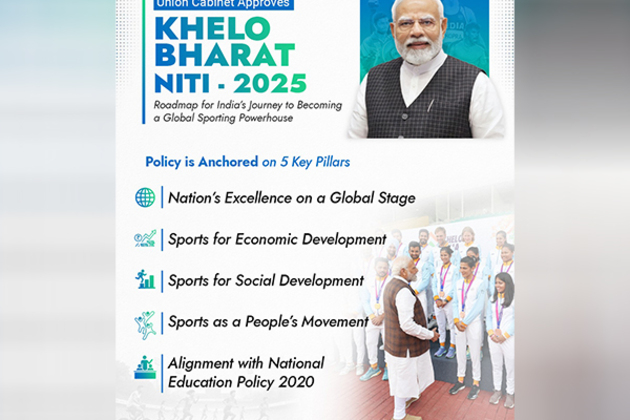

"Landmark day for India's efforts to encourage sporting talent": New National Sports Policy 2025 approval

New Delhi [India], July 1 (ANI): On the occasion of the approval of the new 'Khelo Bharat Niti 2025', Prime Minister Narendra Modi...

Indian Institute of Creative Technologies begins admissions for Animation, Visual Effects, Gaming, in August

Mumbai (Maharashtra) [India], July 1 (ANI): The Indian Institute of Creative Technologies (IICT) opens admissions for its first batch...

Cabinet approves Research and Development and Innovation scheme with corpus of Rs 1 lakh crore to boost strategic, sunrise domains

New Delhi [India], July 1 (ANI): In a significant step to bolster India's research and innovation ecosystem, the Union Cabinet on Tuesday...

Georgia Risks EU Sanctions; Ukraine Hits Roadblocks In NATO, EU Bids

Welcome to Wider Europe, RFE/RL's newsletter focusing on the key issues concerning the European Union, NATO, and other institutions...