Market sentiments teeter as indices open cautiously, anticipating global and domestic signals

ANI

17 Nov 2023, 09:57 GMT+10

Mumbai (Maharashtra) [India], November 17 (ANI): The stock market opened on a cautious note, retracing its steps into negative territory following a positive finish the previous day.

The Sensex began 64.61 points down at 65,889.67, while the Nifty started 9.80 points lower at 19,758.75. The opening figures indicated a mixed trend among Nifty companies, with 35 advancing and 14 declining.

The early trading session saw Asian Paints, Bajaj Auto, Divi's Lab, BPCL, and SBI Life emerge as the top gainers among the Nifty firms. Conversely, SBI, Bajaj Finance, Axis Bank, Bajaj Finserv, and ONGC found themselves among the top losers.

Varun Aggarwal, founder and managing director, Profit Idea, said, "The broader indices showed a mixed trend at the opening, with PSU Banks and Financial services leading the falls. The Bank Nifty index witnessed a notable drop of 505.30 points or 1.14 per cent, concluding at 43,656.25. On the NSE Nifty 50 Index, top losers included the State Bank of India, Bajaj Finance, Axis Bank, Bajaj Finserv, and HDFC Banks. Conversely, the top gainers were BPCL, Asian Paints, Hero MotoCorp, Divis Labs, and HCL Technologies".

The market showed a mixed trend across broader indices, with PSU Banks and Financial Services leading the declines, particularly notable in the Bank Nifty index, which witnessed a drop of 505.30 points or 1.14%, closing at 43,656.25.

The spotlight also turned to Paytm shares as the company's UPI achieved a billion transactions in two months, totalling 11 billion amid the festive season, according to the RBI Bulletin.

Analyzing the positive momentum from the previous trading day, market experts anticipate a favourable short-term outlook for Nifty. Bulls are expected to drive further gains, supported by decreasing inflation.

Technical analysis indicates strong support for corrective declines around Nifty 19,657, with a significant milestone at 19,889 for potential upside movement.

Aggarwal said, "Several positive catalysts contribute to market optimism, including rising copper prices, a decline in WTI crude futures, reduced US-China tensions, optimism regarding Fed rate hikes, strong net buying by FIIs, a weakened US Dollar, lower US Treasury yields, and diplomatic efforts in the Middle East. On the investment front, Foreign Institutional Investors (FIIs) acquired shares worth a net of Rs 975.25 crore, while Domestic Institutional Investors (DIIs) added shares worth a net of Rs 705.65 crore on November 16, 2023, according to provisional data available on the NSE".

Several positive factors contribute to market optimism, including rising copper prices, a decline in WTI crude futures, reduced US-China tensions, optimism regarding Fed rate hikes, strong net buying by FIIs, weakened US Dollar, lower US Treasury yields, and diplomatic efforts in the Middle East.

On the investment front, Foreign Institutional Investors (FIIs) acquired shares worth a net of Rs 975.25 crore, while Domestic Institutional Investors (DIIs) added shares worth a net of Rs 705.65 crore on November 16, 2023, as per provisional data available on the NSE.

The cautious opening sets the stage for an intriguing trading session as market participants gauge the impact of various global and domestic factors on stock movements. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Broadcast Communications news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Broadcast Communications.

More InformationBusiness

SectionWall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...

Taliban seeks tourism revival despite safety, rights concerns

KABUL, Afghanistan: Afghanistan, long associated with war and instability, is quietly trying to rebrand itself as a destination for...

Nvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Tech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Sectors - Broadcasting

SectionSBA participates in World News Media Conference 2025 in Poland

SHARJAH, 7th May, 2025 (WAM) -- The Sharjah Broadcasting Authority (SBA) recently took part in the 76th World News Media Congress,...

France returns military base to Senegal

Paris is withdrawing its troops after the African country scrapped a decades-old defense agreement France has handed over a military...

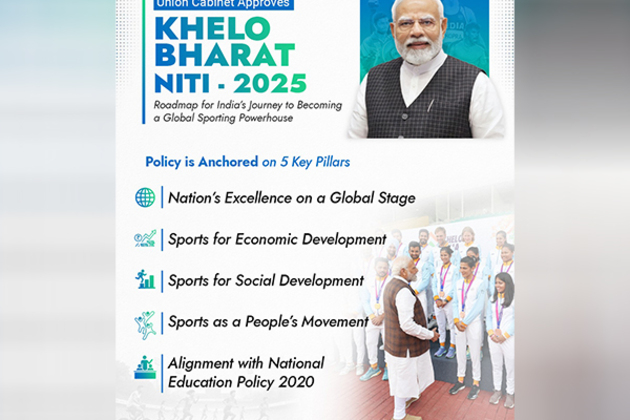

"Landmark day for India's efforts to encourage sporting talent": New National Sports Policy 2025 approval

New Delhi [India], July 1 (ANI): On the occasion of the approval of the new 'Khelo Bharat Niti 2025', Prime Minister Narendra Modi...

Indian Institute of Creative Technologies begins admissions for Animation, Visual Effects, Gaming, in August

Mumbai (Maharashtra) [India], July 1 (ANI): The Indian Institute of Creative Technologies (IICT) opens admissions for its first batch...

Cabinet approves Research and Development and Innovation scheme with corpus of Rs 1 lakh crore to boost strategic, sunrise domains

New Delhi [India], July 1 (ANI): In a significant step to bolster India's research and innovation ecosystem, the Union Cabinet on Tuesday...

Georgia Risks EU Sanctions; Ukraine Hits Roadblocks In NATO, EU Bids

Welcome to Wider Europe, RFE/RL's newsletter focusing on the key issues concerning the European Union, NATO, and other institutions...