Foreign buyers moving away from US debt WSJ

RT.com

19 Nov 2023, 15:43 GMT+10

Share of US Treasuries owned by overseas holders has shrunk significantly in ten years, the media reports

Craving for US outstanding government debt from overseas buyers has significantly reduced with share of Treasury bonds hold by foreign private investors and central banks dropping to around 30% from some 43% ten years ago, the Wall Street Journal reported this week, citing data from the Securities Industry and Financial Markets Association.

At the same time, supply has become more and more inexhaustible, the outlet notes, citing a net $2 trillion in new debt issued by the US Treasury this year. This amount marked an all-time high, excluding the pandemic-related borrowing spree scored back in 2020.

"US issuance is way up, and foreign demand hasn't gone up," Brad Setser, senior fellow at the Council on Foreign Relations, told the journal. "And in some key categories-notably Japan and China-they don't seem likely to be net buyers, going forward."

Demand for the US obligations from foreign investors and central banks, voracious buyers of US debt in the 2000s and early 2010s, is expected to be "more limited," according to the Treasury Borrowing Advisory Committee, a group of Wall Street executives that advise the US Treasury.

In response to sluggish demand, Treasury has recently shifted to issuing shorter-term bonds that are in higher demand, in an attempt to restore market stability. The yield on the US ten-year note that shot above 5% last month is now at around 4.4%.

Data released by the US Treasury earlier this week shows that foreign investors sold a net $2.4 billion in long-term Treasury notes in September, bringing their holdings to $6.5 trillion.

Meanwhile, statistics from the Council on Foreign Relations, which tracks the investments on a rolling 12-month basis, demonstrates that the pace of foreign buying has eased in recent months to around $300 billion, from levels above $400 billion for much of 2022.

A strong dollar has reportedly forced central banks to stop stockpiling US Treasuries or even to sell them down. The regulators, including those in China and Japan, use the dollars they get from selling US debt to boost the value of their own currencies. Investors also remain concerned about the US government's widening deficits.

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Broadcast Communications news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Broadcast Communications.

More InformationBusiness

SectionUS debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Shein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Sectors - Broadcasting

SectionTurning tragedies into ten-fer: Years of toil, tragedy, practice behind Akash Deep's record-breaking Birmingham outing

Birmingham [UK], July 7 (ANI): Indian pacer Akash Deep mesmerised one and all with a ten-wicket haul in a critic-silencing, era-defining...

India's Birmingham hero Akash Deep reveals sister's cancer diagnosis, says playing this match "to make her happy"

Birmingham [UK], July 7 (ANI): Following his side's win over England, Indian pacer Akash Deep revealed that he played the match because...

France returns military base to Senegal

Paris is withdrawing its troops after the African country scrapped a decades-old defense agreement France has handed over a military...

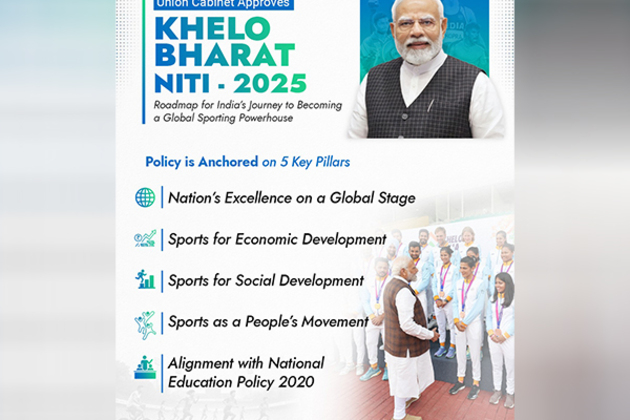

"Landmark day for India's efforts to encourage sporting talent": New National Sports Policy 2025 approval

New Delhi [India], July 1 (ANI): On the occasion of the approval of the new 'Khelo Bharat Niti 2025', Prime Minister Narendra Modi...

Indian Institute of Creative Technologies begins admissions for Animation, Visual Effects, Gaming, in August

Mumbai (Maharashtra) [India], July 1 (ANI): The Indian Institute of Creative Technologies (IICT) opens admissions for its first batch...

Cabinet approves Research and Development and Innovation scheme with corpus of Rs 1 lakh crore to boost strategic, sunrise domains

New Delhi [India], July 1 (ANI): In a significant step to bolster India's research and innovation ecosystem, the Union Cabinet on Tuesday...